massachusetts real estate tax rates

If you wish to obtain information on these rates please call DORs Contact Center at 617 887-6367 or toll-free in Massachusetts at 800 392-6089. How Are Massachusetts Property Tax Rates Calculated.

North Carolina Tax Rates Rankings Nc State Taxes Tax Foundation

The average residential property tax rate for Worcester County is 1584.

. Massachusetts has an 800 percent corporate income tax rate. Counties in Massachusetts collect an average of 104 of a propertys assesed fair market value as property tax per year. The average tax rate in Massachusetts is now 1524 for every 1000 in assessed property value.

Each year local assessors in every city and town in Massachusetts have a constitutional and statutory duty to assess all property at its full and fair cash. FY2022 Residential Tax Rate 1198 per thousand of assessed value. 830 AM to 430 PM Monday through Friday.

Massachusetts Estate Tax Rates. This adds up to 1138 for every 1000 in home value. Massachusetts Property Tax Rates.

While maintaining constitutional checks mandated by law the city establishes tax rates. Have a Property Tax Question. For example if your assessed value is 200000 and your tax rate is 10 your total annual tax would be 2000.

Enter Any Address to Start. This exemption is worth 700 and married people may be entitled to one. Massachusetts Property Taxes Go To Different State 351100 Avg.

Here you will find helpful resources to property and various excise taxes administered by the Massachusetts Department of Revenue DOR andor your citytown. A state excise tax. Detailed Massachusetts state income tax rates and brackets are available on this page.

The reverse is also true when property values increase the tax rate decreases. They are expressed in dollars per 1000 of assessed value often referred to as mill rates. 90000 140000.

Other impacts to future tax rates could include. 104 of home value Tax amount varies by county The median property tax in Massachusetts is 351100 per year for a home worth the median value of 33850000. If you are age 65 or older you may be eligible to claim a refundable credit on your personal state income tax return.

Massachusetts also does not. Generally Massachusetts is a high tax state and the average homeowner pays 114 of their home value every year in property taxes. Download Property Records from the Massachusetts Assessors Office.

The three Worcester County towns with the lowest property taxes are Dudley 1170 Royalston 1221 and Oakham 1272. This is no different from most other New England states like New Hampshire Vermont Maine Connecticut and Rhode Island. 351 rows Last updated.

The towns in Hampden County MA with the highest 2022 property tax rates are Longmeadow 2464 Wilbraham 2049 and East Longmeadow 2029. An owners property tax is based on the assessment which is the full and fair cash value of the property. Chilmark has the lowest property tax rate in Massachusetts with a tax rate of 282 while Longmeadow has the highest property tax rate in Massachusetts with a tax rate of 2464.

Massachusetts Property and Excise Taxes. Quincy MA 02169 617 376-1000 Hours. Ad Find Recommended Massachusetts Tax Accountants Fast Free on Bark.

For the current fiscal year the total amount of property taxes that Gardner can collect is 31271792. Check the local laws. According to Massachusetts General Law and the restrictions of Proposition 2 ½ the City cannot raise taxes more than 2 ½ each year.

Ad Learn About Property Value Taxes Sales History More. The average single-family property tax bill in Massachusetts in 2021 is 6372 up 197 from the previous year according to a recent report conducted by the Division of Local Services Massachusetts Department of Revenue. July 13 2022 Massachusetts property real estate taxes are calculated by multiplying the propertys value by the locations real estate tax.

370 rows Massachusetts Property Tax Rates by Town. The maximum credit amount for tax year 2021. Source MLSPIN April 6 2022 View All Towns View by County.

To get a Massachusetts property tax exemption for seniors you need to be 65 or older before the end of the year. Visit my blog to learn a bit more about real estate taxes. Massachusetts has a 625 percent state sales tax rate and does not levy local sales taxes.

Property tax is an assessment on the ownership of real and personal property. Do you have a question about property tax. The towns in Worcester County MA with the highest 2022 property tax rates are Bolton 1987 Lancaster 1945 and Sturbridge 1915.

The average residential property tax rate for Hampden County is 1769. All real estate not eligible for exemption should be taxed evenly and uniformly on one present market value basis. Provided for informational purposes only - please refer to massgov or each towns municipal website for most accurate tax rate info.

A state sales tax. Interest - The Massachusetts interest rates for underpayments and overpayments of state taxes can change each calendar quarter. This means you should not expect your property taxes paid the following year to be less than the year before.

The Senior Circuit Breaker tax credit is based on the actual real estate taxes paid on the Massachusetts residential property you own or rent and occupy as your principal residence. Rate Threshold 0 40000. What that means is for the same house it is more expensive to live in Longmeadow than in Chilmark because the property taxes are higher in Longmeadow.

Massachusetts laws have to be adhered to in the citys handling of taxation. The three Hampden County towns with the lowest property taxes are Tolland 900 Montgomery 1395 and Blandford 1479. Taxpayers must also be given a prompt notification of rate hikes.

Tax rates in Massachusetts are determined by cities and towns. The Massachusetts income tax has one tax bracket with a maximum marginal income tax of 500 as of 2022. Town Hall Hours Mon - Fri 830am - 430pm Open until 800pm on the 1st.

A local option for cities or towns. What is the difference between a Preliminary Tax Bill and an Actual Tax Bill. Of that 167 billion or 216 of the total revenue collected is from property taxes.

In Kentucky all in-state property is subject to the inheritance tax regardless of where the heir lives. 625 state sales tax 1075 state excise tax up to 3 local option for cities and towns Monthly on or before the 20th day following the close of the tax period.

Massachusetts Tax Rates Rankings Ma State Taxes Tax Foundation

Massachusetts Sales Tax Small Business Guide Truic

2021 Personal Income And Corporate Excise Tax Law Changes Mass Gov

Property Tax How To Calculate Local Considerations

Massachusetts Estate Tax Everything You Need To Know Smartasset

A Guide To Estate Taxes Mass Gov

Massachusetts Estate Tax Everything You Need To Know Smartasset

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

Massachusetts Estate Tax Everything You Need To Know Smartasset

Massachusetts Property Tax Calculator Smartasset

Property Taxes By State Quicken Loans

Florida Real Estate Taxes And Their Implications

Property Taxes How Much Are They In Different States Across The Us

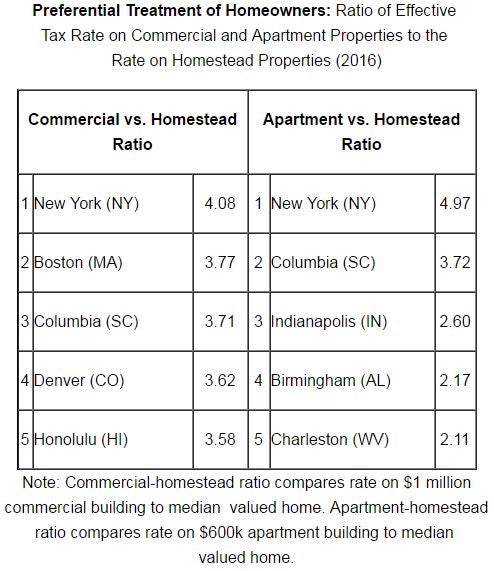

Lincoln Institute Releases Annual 50 State Property Tax Report Lincoln Institute Of Land Policy

Massachusetts Tax Rates Rankings Ma State Taxes Tax Foundation

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

State Corporate Income Tax Rates And Brackets Tax Foundation